Overview

BeniPlus is a Canadian employee benefits administration platform that manages Healthcare Spending Accounts (HSA), Wellness Spending Accounts (WSA), RRSP, TFSA, Personal Insurance, and Charitable Giving for employers across Canada. The platform handles the full lifecycle — benefit allocation, claims processing, adjudication, and EFT payouts — for a growing base of employers and their employees.

Futurify has been BeniPlus’s long-term development partner, building the core platform and delivering the features that transformed it from a single-product tool into a multi-channel enterprise benefits platform.

The Challenge

BeniPlus had a working platform, but three structural limitations were capping growth:

-

No Partner Channel — BeniPlus could only sell direct. Insurance brokers and benefits consultants — the primary distribution channel in Canadian group benefits — had no way to manage clients on the platform. This locked BeniPlus out of the broker network entirely.

-

Single-Plan Architecture — The system assumed one benefit plan per employer. Enterprise employers with multiple employee tiers (executives, full-time, part-time) couldn’t be served. This eliminated the most valuable segment of the market.

-

Paper-Based Claims — Employees submitted claims through a clunky web process. Low utilization meant employers questioned the value of the benefit, leading to churn.

Our Approach

Partner Portal & Commission System

- Hierarchical Permission Architecture — Built a multi-tier permission system allowing partners (brokers/consultants) to manage their client employers and employees without seeing other partners’ data. This required a fundamental architectural shift from the existing flat role model — the initial approach caused cascading side effects across 8+ services, requiring a pivot to a dedicated

BeniplusUserPermissionEvaluatordesign. - Commission Payout Engine — Automated monthly commission calculation, tracking, and EFT payouts to partners. Initially attempted async processing via message queue; pivoted to synchronous after discovering stability issues during testing — ensuring partners get paid reliably every month.

- Partner Onboarding Flow — Self-service portal for brokers to register, manage clients, and track commissions in real time.

Multi-Plan Feature

- Data Model Overhaul — Refactored the deeply coupled “one plan per employer” assumption across dozens of APIs. Plan and Class settings were restructured to support unlimited benefit tiers per employer.

- Historical Data Tracking — Implemented temporal snapshots (

employee_class_benefit_history) so year-end calculations account for mid-year plan changes — previously, updates overwrote records and lost critical history. - Claim Separation Logic — Built edge-case handling for employees who change plans mid-period, ensuring claims are allocated to the correct plan window.

Mobile Benefits App

- Claims in Three Taps — Receipt upload, claimant selection, and spending account choice — all from a native mobile experience with Face ID authentication.

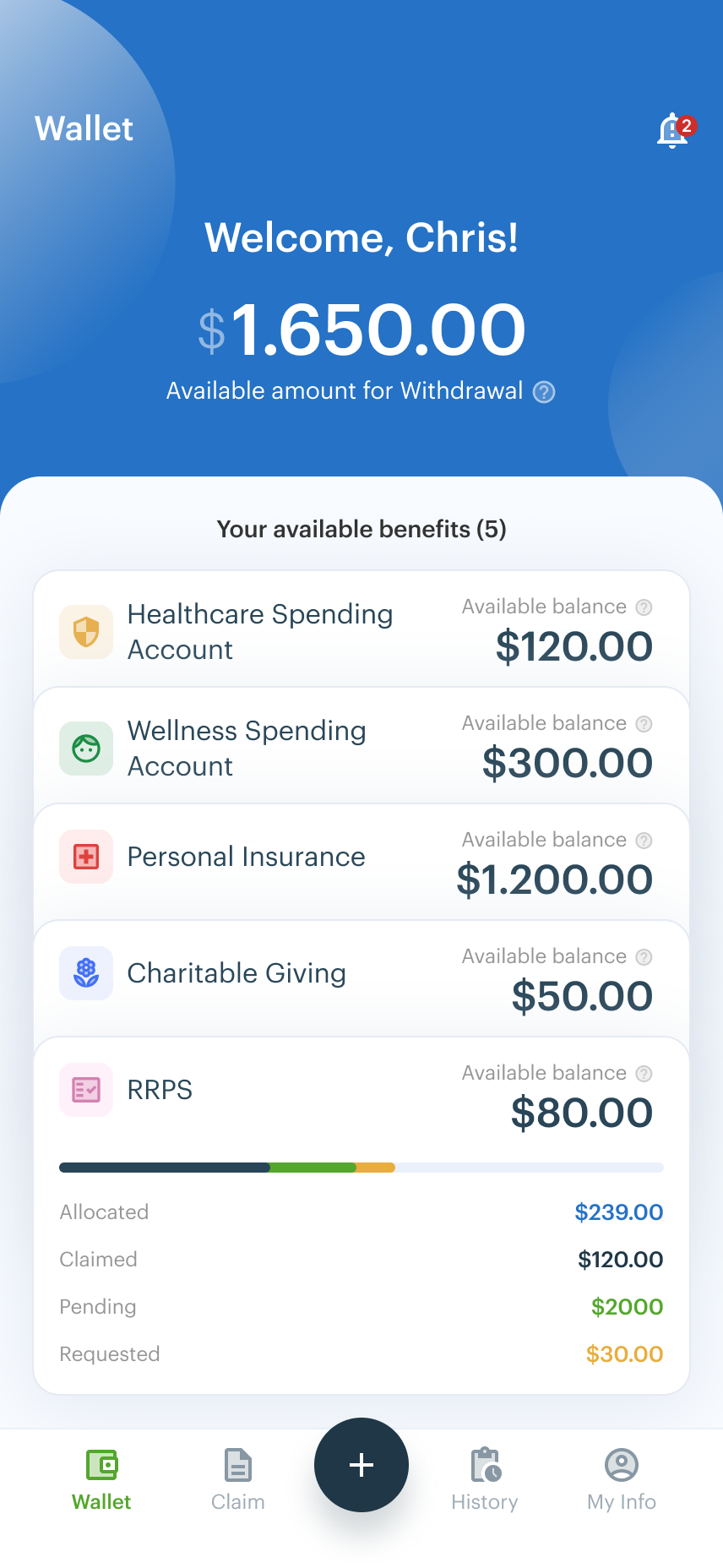

- Unified Wallet — Single view of all benefit balances (HSA, WSA, RRSP, TFSA, Personal Insurance, Charitable Giving) so employees always know what’s available.

- Marketplace Discovery — Location-based provider search using Haversine formula distance calculations, letting employees find nearby eligible providers.

Operational Improvements

- Job Scheduling Refactor — Migrated from rigid cron-based scheduling to a database-driven system that handles varying provider requirements (fixed dates, offset days, business-day exclusions). New provider onboarding went from weeks to days.

- Monthly Reconciliation — Built automated reporting and EFT-to-claim mapping for employer financial reconciliation.

Results

Revenue Impact

- New distribution channel — Partner Portal opened the insurance broker network, the primary sales channel in Canadian group benefits. Partners can now sell, onboard, and manage BeniPlus clients independently.

- Recurring commission revenue — Automated monthly commission payouts create a self-sustaining partner incentive structure that drives organic growth.

- Enterprise market unlocked — Multi-plan support enabled BeniPlus to serve employers with multiple employee tiers — the highest-value segment in benefits administration.

Operational Efficiency

- Claims processing time reduced — Mobile app simplified submission from a multi-step web process to three taps, increasing employee benefit utilization.

- Provider onboarding from weeks to days — Database-driven job scheduling eliminated manual configuration for each new benefits provider integration.

- Year-end accuracy — Historical data tracking eliminated the data-loss problem that previously required manual reconciliation at renewal time.

Technical Scale

- 6 benefit categories managed across HSA, WSA, RRSP, TFSA, Personal Insurance, and Charitable Giving

- 9+ developers collaborating across frontend (React), backend (Java/Spring Boot), and database (MySQL)

- 15 major R&D initiatives delivered over a 10-month period, including 5 that were undocumented in tickets and only discoverable through code analysis

- Third-party integrations including Maple group insurance product and external broker APIs

Technologies

Java, Spring Boot, React, TypeScript, MySQL, AWS, REST APIs, EFT Payment Processing, Google Places API, Mobile (iOS/Android), CI/CD Pipelines

.png)